The Ten Status Quo And Four Trends Of Energy Storage In 2024

Date:2024-02-27 Views:578

PART/1 High growth of installed capacity

China is the rising star of the global new energy storage market.

On January 25, 2024, the National Energy Board held a press conference. Data show that by the end of 2023, the cumulative installed capacity of new energy storage projects in the country has reached 31.39 million kW / 66.87 million KWH, and the average energy storage time is 2.1 hours. In 2023, the newly installed capacity will be about 22.6 million kW / 48.7 million KWH, an increase of more than 260% from the end of 2022, and nearly 10 times the installed capacity at the end of the "13th Five-Year Plan".

According to the "Guidelines on Accelerating the Development of New Energy Storage" issued by the National Development and Reform Commission and the National Energy Administration, by 2025, the installed capacity of new energy storage will reach more than 30 million kilowatts. It can be seen that by the end of 2023, China's new energy storage has completed the 2025 installation target ahead of schedule.

This is mainly due to the intensive introduction of favorable national policies, the increasingly mature business model of new energy storage, and the initial investment cost of the system continues to decrease.

PART/2 Low price internal volume, the drop is close to half

On the one hand is the rapid expansion of capacity, on the other hand is the faint stall of the market.

Combing through the development context of 2023, it is not difficult to find that the price war in the field of energy storage first began to come from the field of structural excess cells, and then the price of the DC system continued to fall, and then the AC system price war continued to fall.

The average price of energy storage cells fell from 0.9-1.0 yuan /Wh at the beginning of 2023 to 0.4-0.5 yuan /Wh at the end of the year, and the price was directly cut in half. At the same time, compared with the beginning of the year, the average price of energy storage systems dropped to about 0.8 yuan /Wh, down 40%, and nearly halved.

PART/3 Energy Storage IPO road now "withdrawal tide"

In August 2023, the CSRC announced a phased tightening of the IPO (initial public offering) rhythm to promote the dynamic balance at both ends of investment and financing. Many energy storage companies are starting to slow down the pace of ipos.

According to incomplete statistics, there are nearly 400 investment and financing events related to the energy storage field in 2023, and the financing scale may reach more than 100 billion, with more than 100 energy storage companies queuing up for ipos, more than 20 companies completing ipos, but there are also more than 20 energy storage related companies terminating their listings. The reason is that the CSRC believes that some energy storage enterprises lack core competitiveness.

PART/4 Industrial and commercial energy storage enters the first year of development

As the peak-valley price spread across China has further widened, the cost of stacked lithium batteries has declined, and the IRR(internal rate of return) of industrial and commercial energy storage has steadily increased, and the economy has become more and more obvious. Industrial and commercial energy storage has become the fastest growing branch of the energy storage track. In 2023, the user-side industrial and commercial energy storage capacity (lithium battery energy storage system) will be close to 2GWh, and it will still maintain a high growth rate in 2024-2025, knowing that the total size of this market in 2022 is only hundreds of MWh.

PART/5 Household storage market "sharp turn down"

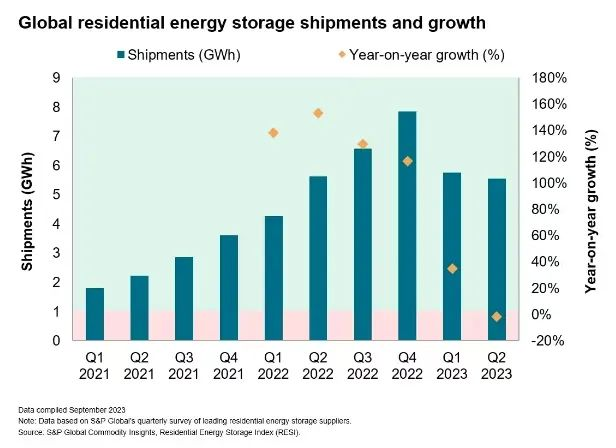

Since 2023, the accelerated cooling of the household storage market has become a recognized fact of the industry, which can be described as "ice and fire" compared with the grand situation in 2022. According to S&P Global, global shipments of household energy storage systems fell for the first time year-on-year in the second quarter of 2023, and for the first time on record - down 2% year-on-year.

H1 shipments of 2023 household energy storage are about 6GWh, and the annual forecast is significantly lowered. Based on this, the first task of household storage enterprises is to clear inventory. According to relevant statistics, the European household energy storage market will reach 9.57GWh in the whole year of 2023, the inventory digestion in the second half of the year will reach about 4.47GWh, and the clearance of household storage inventory is expected to continue until the end of 2023 and the beginning of 2024.

PART/6 Energy storage battery from 280Ah to 300+Ah iteration

With the increasingly vigorous energy storage market, energy storage battery products are developing towards large capacity. By 2023, 280Ah square batteries will rapidly penetrate the market with large capacity, high safety, high energy density and mature mass production processes. Since 2023, in order to comply with the future trend of larger energy storage market and larger capacity, the energy storage market is mainly focused on 300Ah+ large-capacity batteries.

By the end of 2023, nearly 30 domestic battery manufacturers, such as Ningde Times, Yiwei Lithium Energy, Honeycomb Energy, Rupu Lanjun, Nandu Power Supply, Penghui Energy, Haichen Energy storage and Ganfeng Lithium, have successively launched cell products with a capacity of more than 300Ah.

The intensive launch of 300Ah+ energy storage batteries reflects the positive growth and technology iteration of the energy storage market. Further, in order to layout the future market, some battery companies have launched 500Ah+, 600Ah+, 1000Ah+, blade batteries and other technical reserves.

PART/7 20 ft 5MWh liquid cooled energy storage system competition

At the same time as the cell capacity is increased, the era of 5MWh+ energy storage system has also arrived. In 2023, at least 20 energy storage companies have successively released 20-foot 5MWh energy storage systems based on 314Ah/320Ah large cells.

The scale of energy storage cells has increased, the number of battery clusters in parallel has increased, the problems of battery heat dissipation and balance have become prominent, and the requirements for safety and temperature control technology are also higher, and the liquid cooling scheme is replacing air cooling to become the mainstream energy storage system cooling technology. In 2023, there is no doubt about the battle between air cooling and liquid cooling, and liquid cooling has become a major manufacturer competing to launch liquid cooling products. According to GGII, the market share of liquid cooling solutions will exceed 50% in 2025.

PART/8 Energy storage goes to sea, and new changes are brewing on the global track

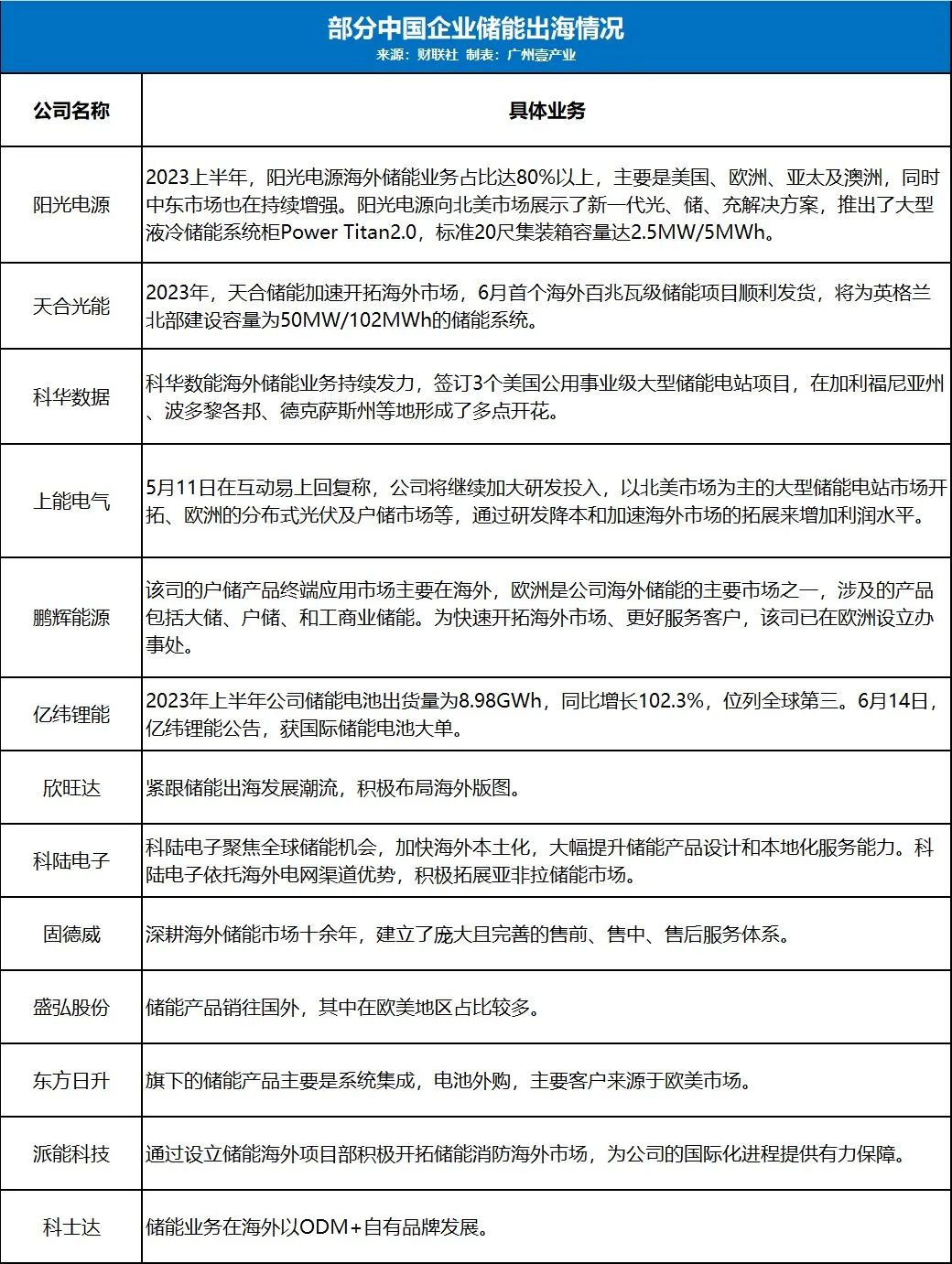

Go to sea, become the key word of energy storage. From the perspective of the global market, China, the United States and Europe are currently the world's top three energy storage markets. According to the European Energy Storage Association estimates, to 2030 need to deploy about 200GW of energy storage, that is, an additional 14GW per year; 600GW of energy storage will need to be deployed by 2050, or 20GW per year after 2030. In terms of overseas markets, analysts said that the European and American markets, due to the high degree of electricity marketization and good profitability, have become an important business layout direction for China's head energy storage industry chain enterprises. The listed companies with overseas layout of energy storage related businesses are mainly Sunshine Power, Trina Solar, Kehua Data, Shangneng Electric, Penghui Energy, Yi Wei Lithium Energy, Xinwang Da, Kelu Electronics, Goodewei, Shenghong Shares, Oriental Sunrise, Pineng Technology, Kestar and so on.

PART/9 Grid type energy storage has come into public view

From "following the network" to "constructing the network", in 2023, the grid type energy storage has initially entered the public vision. This requires a new control strategy to be added to the energy storage system on the new energy side, so that it has the frequency regulation and voltage control capabilities of synchronous generators or similar synchronous generators, and forms a grid type energy storage system.

The reason is that the proportion of new energy generation has increased rapidly, the power system has gradually shown the characteristics of "double high" (high proportion of renewable energy, high proportion of power electronic equipment), the production structure, operating mechanism, functional form of the power system is undergoing profound changes, low inertia, low damping, weak voltage support and other problems are prominent, and the safe and stable operation of the power system is facing serious challenges.

PART/10 Flow battery commercialization speed up

Flow batteries have intrinsic safety characteristics and have advantages in the field of energy storage with high safety requirements, although flow batteries are in the early stage of commercialization, but with the long-term energy storage trend gradually clear, the heat of flow batteries only increases. According to incomplete statistics, in 2023, China's flow battery capacity planning has exceeded 90GWh, the investment amount exceeds 41.7 billion, and nearly 40 projects have been signed/under construction/put into production. The development of flow batteries has accelerated significantly, and domestic flow battery shipments will exceed 10GWh(measured by 4 hours, including exports) in 2025, with a compound growth rate of more than 90%.

Now, standing at the starting point of 2024, can we "shake off the clouds and see the moon"? Based on the background of the price war, the development of energy storage in 2024 will have these four "key points" :

① Battery enterprises from "roll" battery to "roll" system

As battery companies join the energy storage system integration circuit, industry competition is becoming increasingly fierce, and many battery factories including Ningde Times, BYD, Yiwei Energy storage, Rupu Lanjun, Haichen energy storage, Honeycomb Energy began to gradually get involved in the integration business. Battery factories have developed new energy storage system, in addition to DC side products, many companies have also developed AC side system new products, application scenarios covering the power side, industrial and commercial side, user side, etc., directly participate in the field of energy storage competition. If the cell manufacturer transforms into a system-wide role, it may compete with existing customers and integrate all aspects of the game.

② It is better to go to sea than to roll in

From the market share point of view, the overseas market demand is large, but also more and more energy storage companies choose to go to sea to seek a way out. In addition to traditional mainstream energy storage markets such as Europe and the United States, Australia, and Japan, Southeast Asia, Africa and the Belt and Road countries have also become important target markets.

(3) Energy storage industry from price driven to value driven appeal

Behind the internal volume, the energy storage industry is accelerating to value driven, and the market is not seeking low prices, but the real cost reduction ability. For example, on the industrial and commercial side, the back-end capabilities of energy storage companies have accelerated to the surface, and advanced technologies such as AI and big data analysis have been used to enhance the benefits of owners.

The new incremental market for energy storage is being tapped

First of all, in addition to the current domestic power generation side of the new energy distribution and storage, traditional user side and other energy storage fields, industrial and commercial energy storage application scenarios are constantly being excavated. Third, continue to explore the scope of product use, break through the upper limit of lithium battery use.

Article source: China Energy storage network